Condo Insurance in and around Paducah

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

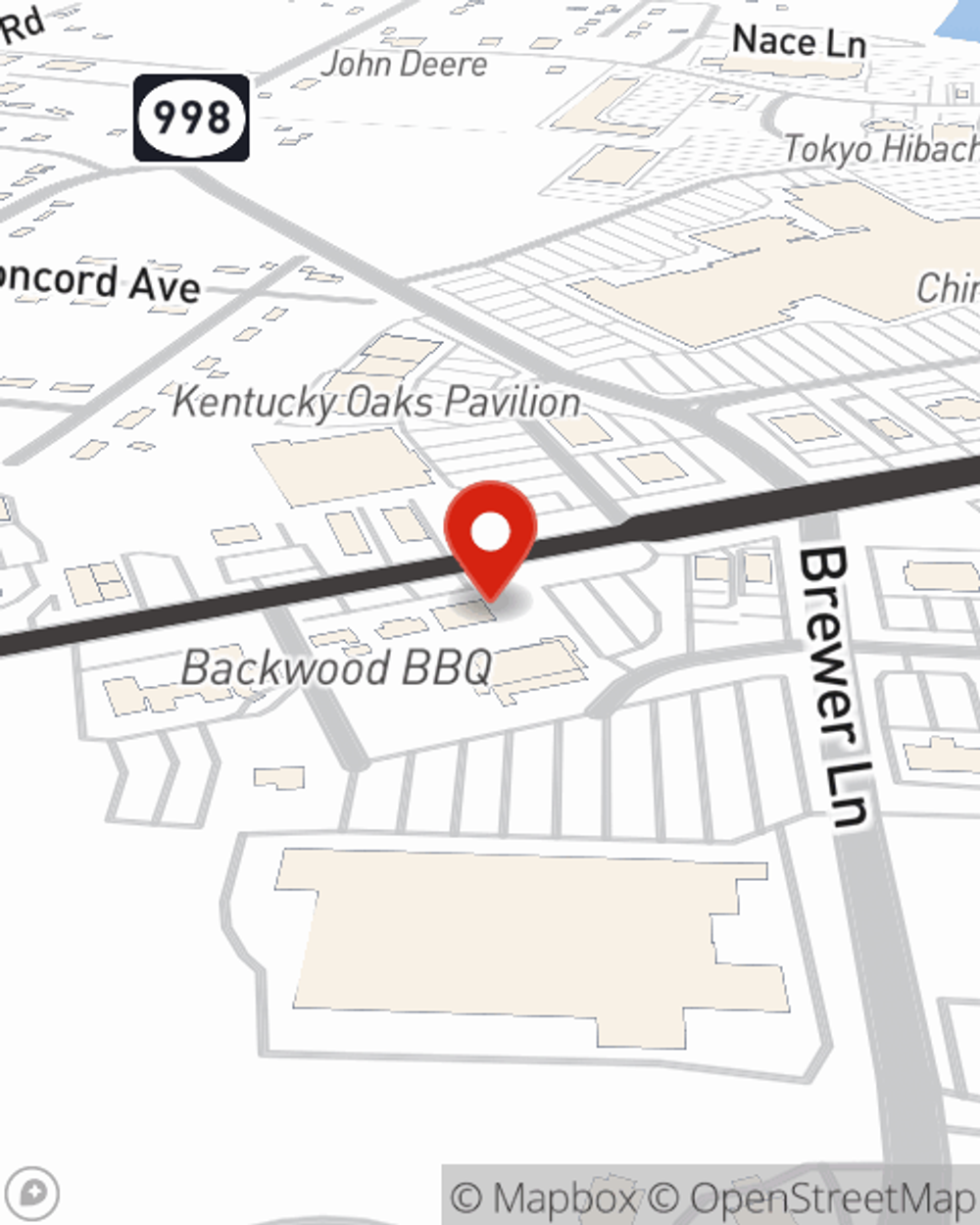

- Paducah, KY

- Kentucky

- Mayfield, KY

- Tennessee

- Illinois

- Metropolis, IL

- Benton, KY

There’s No Place Like Home

Committing to condo ownership is an exciting decision. You need to consider cosmetic fixes your future needs and more. But once you find the perfect condominium to call home, you also need dependable insurance. Finding the right coverage can help your Paducah unit be a sweet place to call home!

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Agent Shane Andrus, At Your Service

With this coverage from State Farm, you don't have to be afraid of the unexpected happening to your unit and personal property inside. Agent Shane Andrus can help lay out all the various options for you to consider, and will assist you in constructing a terrific policy that's right for you.

Finding the right protection for your unit is made painless with State Farm. There is no better time than today to contact agent Shane Andrus and check out more about your great options.

Have More Questions About Condo Unitowners Insurance?

Call Shane at (270) 443-4002 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Shane Andrus

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.